Mobile View Put Simplifying Financial Convenience

Posts

You will want to next discover the gambling enterprises offering incentives and you will believe that approach. The newest safer solution to deposit checks in the moments to your Fidelity Assets application—no lines, no wishing. If you’re also relaxing on the sofa otherwise on the run, you could still put monitors with your pill or cellular phone. When you yourself have membership at the various other banks otherwise must posting currency to help you someone else’s account, of numerous banks let you do that easily because of their on the internet banking devices. Would you like to transfer money between your profile or found payments out of someone otherwise team?

To possess cellular dumps, the capital One Mobile app will teach their max put matter. If you want to put an amount which is more the limit, visit a part otherwise Funding You to definitely Atm. You could potentially connect your own qualified examining or checking account so you can an membership you have during the various other financial.

Prove the newest consider count is within mobile deposit constraints

If you wish to put an expense that is over the brand new limit, check out our twigs otherwise ATMs. To learn more about the kinds of inspections you can and you will likely is’t put during your Funding One to Cellular app, here are some these types of cellular put terms and conditions. Cellular take a look at deposits provide unmatched hassle; forget seeking out an automatic teller machine otherwise wishing in the teller drive-as a result of outlines. It’s not necessary to exit your home to get a check on the account, and you may do it when of go out otherwise night.

This could be a company rules – elizabeth.g., a supplier may only ensure it is, state, $a hundred otherwise $150 total monthly inside service provider asking purchases. It’s value checking together with your company if you intend to utilize this method frequently. ❌ Monitoring your using might possibly be more complicated than simply with other alternatives, as you’ll get the full information with your month-to-month mobile phone expenses. At this real cash cell phone gambling enterprise, you’ll find many techniques from online slots to a real time dealer section, and everything in anywhere between. Mobile take a look at deposit is here to remain, and its own upcoming looks guaranteeing.

The lending company must see the papers find out if indeed there’s an issue with the order, such as a fuzzy photos or too much deposits. Once taking pictures of your own consider, you’ll need get into your own deposit matter, establish the details and then post the transaction up on your own bank otherwise borrowing from the bank relationship. Paycron could have been a chief within the bridging the fresh pit between merchants and you will credit card merchant account company. Your organization may be worth great growth that’s achievable having safe and you may end-to-end payment processing. I focus on strong fee possibilities for all payment versions, ensuring that your business, whatever the dimensions, remains well-connected.

They provide unrivaled comfort and you may security features, causing them to good for a lot of users. Examples of this type of notes are Charge card, Western Share, and you may Visa. Deposits are typically quick – but withdrawals usually takes a short while to help you procedure. Pay-by-cellular and Boku gambling enterprises are very comparable however, disagree in the a particular element. A wages-by-mobile gambling enterprise allows players to help you put financing through smartphone billing, level a variety of systems and techniques, age.grams., Texting commission and you will direct company billing.

Do you need to remain a check once using mobile put?

The newest software will make suggestions when deciding https://mrbetlogin.com/lady-in-red/ to take photos of one’s check’s back and front. You won’t make use of phone’s normal digital camera unit for this; you will be guided to do it myself through the app, with let for the properly position the fresh view. Financial features available with Neighborhood Federal Offers Financial, Member FDIC.

For example, Investment One users is also fundamentally put You.S. personal, company or authorities inspections using their Investment One Cellular application. Broker features for Nuclear are given by Nuclear Brokerage LLC (“Nuclear Brokerage”), person in FINRA/SIPC and you will a joint venture partner away from Atomic, and that produces a conflict of interest. Come across details about Atomic, within Form CRS, Function ADV Part 2A and you may Privacy policy. Find details about Nuclear Broker inside their Setting CRS, Standard Disclosures, percentage plan, and you may FINRA’s BrokerCheck.

There are a few conditions, very listed below are some our very own Terminology & Conditions for an entire listing. The new app have a tendency to help you put the look at within the physical stature and make certain right lighting. Explore a dark colored record to help the brand new view facts stand out demonstrably regarding the photos. If you use particular ad blocking application, excite consider the options. A deck intended to show all of our operate geared towards using the attention from a better and a lot more clear gambling on line industry to help you facts. Cellular money are in the public domain while the 90s, in the event the enjoys away from Sony Ericsson and Coca-cola tried to buy products thru Texting.

To your as well as top, consider dumps at the ATMs often will enables you to access a great small amount immediately, along with the rest clearing another business day. Mobile deposit enables you to safely and easily put inspections from your cellular phone when, usually using your financial institution’s app, removing the need to go to an atm or branch. Not so long ago, the only method to deposit a magazine take a look at was to go for the otherwise push up to a financial department and you can keep in touch with a teller. Afterwards, some ATMs already been taking inspections along with dispensing cash, however with the newest adoption out of cellular take a look at transferring, something had easier. Mobile put are a component offered in most banking apps one to enables you to digitally fill in take a look at dumps into the membership twenty four/7, from the absolute comfort of our house.

- While the charge try billed on the mobile phone, you are going to spend they along with her the very next time it is due.

- Find the “Deposit” solution then find “Pay-by-Mobile” as your percentage strategy.

- Keep in mind that you provide no lender otherwise cards info when using pay from the cellular telephone, and therefore it will get a limit whenever cashing away.

- Direct put is one of the most smoother how to get money in to your membership, and it also goes automatically.

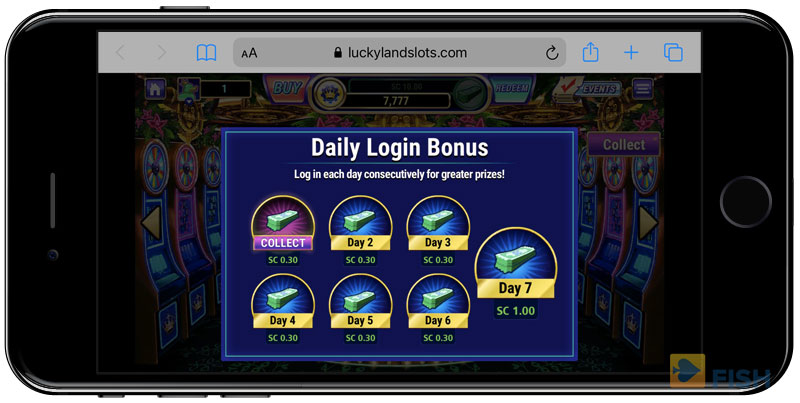

The menu of pay from the cellular gambling enterprises is often altering, to your Sports books.com team always looking for gambling enterprise web sites that offer this form away from fee approach. Regarding the second a couple, this is how you’ll become verified, that have users then capable like to make in initial deposit from the cellular phone. Before you can begin, take a look at if the financial offers mobile consider deposit. Most top banking institutions give this specific service, but it’s essential to establish this particular aspect can be acquired to your. For individuals who’lso are unsure, see your lender’s webpages otherwise call customer support. As well, make sure your account is actually a great condition, as the certain banking companies could have certain criteria otherwise limitations to own cellular places.

With Wells Fargo Mobile deposit (“cellular deposit”), you could make in initial deposit in to their eligible examining or bank account utilizing the Wells Fargo Mobile software. If the financial offers cellular take a look at deposit and you refuge’t tried it but really, unlock the brand new software the next time you get a check. If you see how quickly and easy it is, you will never return to status in-line from the financial. Mobile look at deposit lets you include currency to your checking account rather than visiting a department.

For many who head a busy lifestyle, then and then make a phone percentage is very good because it’s more speedily than by hand typing on your card details – and it’s not necessary to bring an actual physical little bit of vinyl. To have app costs, your data has already been kept, which means you just need to ticket the protection standards – either simply a great fingertip check – and you will enter the matter you want to transfer. Whenever websites customers choose to shell out by the cellular telephone rather than through antique debit or handmade cards, they do therefore for different reasons, however, perhaps the head a person is protection. Today investing by the mobile phone try better and you can its standardized with many different people in the new create world and make several transactions a day. The brand new quantity of mobile wallets and compatible websites form cellular telephone payments becomes more popular than an excellent debit or credit card soon. You could put a wide range of look at versions into the membership when you put a check on line.

With more and more folks playing with mobile phones to own day to day life, an upswing away from cellular deposit possibilities has grown somewhat. The brand new Gaming Payment’s on the web tracker questionnaire within the 2021 signifies that 60% of online bettors have tried a mobile phone in order to gamble on the. Although not, the newest Pay because of the Cellular payment approach isn’t appropriate because of their a hundred free spins invited render. With more than 2,600 game, and you may expert offers for brand new and you may current players, it’s a strong solution when it comes to pay by the cellular phone casinos.